Download the full PDF report here

February 2015

Executive Summary

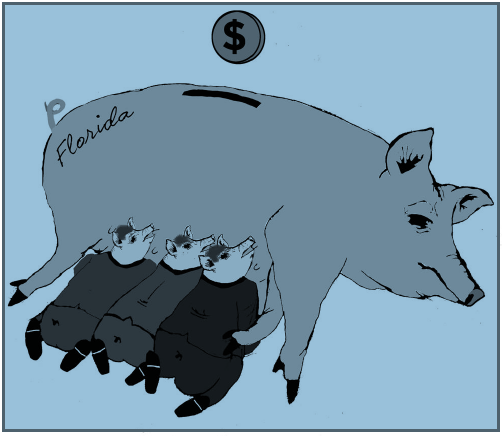

As Florida policymakers consider cutting corporate profits tax revenues, this study seeks to

provide more transparency about the actual corporate profit tax rates being paid by the Fortune

500 corporations headquartered in Florida to state governments in the U.S.

While the Florida Legislature maintains a policy of secrecy that prevents disclosure of corporate

profits tax payments made by individual corporations, the staff of Citizens for Tax Justice (CTJ)

and the Institute on Taxation and Economic Policy (ITEP) conducted a special study of state

corporate profits tax payments made by Florida’s 17 Fortune 500 corporations nationally at the

request of Integrity Florida. CTJ/ITEP used the same methodology it has used in its periodic

national reports of state corporate profits taxes in order to determine estimates of corporate

profits, corporate profit taxes paid and corporate profit tax rates.

Thanks to the data provided by CTJ/ITEP, Integrity Florida found that all of the profitable

Fortune 500 corporations headquartered in Florida paid state governments in the U.S. on average

a lower corporate profits tax rate than Florida’s 5.5 percent rate between 2011 and 2013. Most of

these corporations have received taxpayer-funded subsidy deals and government contracts. The

corporations examined in this report have also spent heavily on state-level political campaign

contributions and legislative lobbying in Florida.